Al Hayer GCC Fund

Objective

The Fund will invest primarily in shares and other securities issued by companies established or operating in GCC and MENA countries and other countries approved by the Founder and Fund Manager. However, the Fund Manager will have the flexibility to invest in initial public offerings of shares of companies in these countries, money market and fixed income instruments, bank deposit accounts, sovereign bond issues of GCC countries, other funds and unit trusts both investing predominantly in securities of companies listed on Qualifying Exchanges. An unspecified percentage of the Fund's Net Asset Value will be held in the form of cash so as to facilitate new investments by the Fund or redemption of Units.

Fund Overview

| Fund Manager | Amwal LLC |

| Fund Founder | Doha Bank Q.S.C. |

| Investment Team | Talal Samhouri, CFA |

| Administrator and Custodian | HSBC Bank Middle East Ltd |

| Auditors | Ernst & Young Qatar |

| Fund Type | Open-Ended |

| Inception Date | September 2013 |

| Subscription/Redemption | Monthly |

| Management Fee | 1.50% p.a. |

| Performance Fee | 15% Over 10% Hurdle Rate |

| Fund Website | www.alhayerfund.com |

"Al Hayer GCC Fund is unique in that it invests in the GCC and Mena markets and aims to deliver above average returns with below average risk through investing in a diversified and carefully selected portfolio of companies across major market sectors."

- GUlf Times

Manager's Commentary

The Saudi market continued to be the worst performing stock market in the region, and this month it was followed by the Qatari Market, both declining during the month by 7.5% and 5%, respectively. Declining oil prices, negative news flow from the Saudi construction sector and harsh austerity measures in Saudi Arabia had a negative impact on the path of GCC markets. But by end of the month a positive surprise occurred in Algeria about OPEC's promise to cut production for the first time since 2008.

For Al Hayer Fund, we have continued increasing the cash allocation to about 13% as markets continued its decline. We have also reduced exposure to the Financials sector to about 39% from about 47%, since the sector, especially in Saudi Arabia, will be the hardest hit in the event of increased defaults in the system. While at the same time, we have diversified into consumer staples, chemicals and telecom, taking a defensive stance in anticipation of a dismal 3Q results.

Despite the heavy losses the Saudi market has exhibited this year, we believe that over the next few months it will recoup 2016 losses, as clarity increases on government measures and stability of oil prices in the range of $45-55 per barrel.

Performance

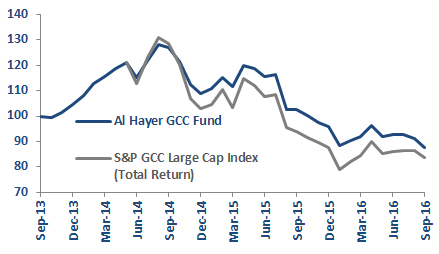

Regional equities continued their sell-off in May with the fund's benchmark S&P GCC Large Cap Index declining -5.2%. In comparison the Al Hayer GCC Fund declined -4.5% (net after fees and expenses) during the same period.

Despite oil price recovering to about US$ 50 per barrel of Brent towards the end of May, we find the continued drop in GCC stocks related primarily to future prospects of government spending. Saudi Banks and real estate in general were among the worst hit, declining around 8-10%.

In brief we see current levels as quite attractive to selectively increase investment in GCC equities. We will shortly be publishing a more detailed report sharing our analysis on valuations, prospects and risks.

Al Hayer GCC Fund Performance

Al Hayer GCC Fund Documents

Factsheet 2018

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

Factsheet 2017

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

Factsheet 2016

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

Factsheet 2015

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015