Amwal Investment Outlook

No reason for ‘excessive worries’ on price dip

December 02, 2014

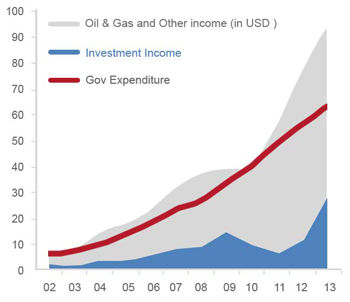

DOHA: Given the current supply demand dynamics for oil, Brent is expected to stabilise between $80-90 per barrel in the near to medium term. Currently, there is no reason to get “excessively worried” about the prospects for long term oil price, or the region’s growth, an investment expert at a leading independent asset management firm said yesterday. There is a correlation between the speed at which mature economies invest in exploring alternative energy sources and the price of oil. At $70 per barrel, there will likely be a marked slowdown in those investments and therefore the dependence and demand for oil is likely to continue, Afa Boran, head of asset management, Amwal told The Peninsula. However, as the region’s economies are mainly driven by hydrocarbon revenues, drop in prices will have a marginal impact on corporate profits, he said. Explaining on the historical relationship between Qatari government’s revenues and spending, Afa noted the level of spending increase over the past five years significantly in line with the steady increase in oil and gas income. The growing revenue from the oil and gas was also the driver behind the rapid growth of the economy during that period. Similar increases in government spending were seen in other hydrocarbon-rich GCC countries. For instance, the government increased spending from $160bn in 2009 to around $260bn in 2013. “This increase has also led to strong corporate earnings growth of around 70 percent in Qatar and around 50 percent in the broader GCC region. Should oil however remain at $70 or lower, this will inevitably result in depletion of surpluses and will most likely result in a near to medium term adjustment in the fiscal budgets,” he said. Based on latest reported earnings, Qatari stocks are now trading at a P/E of c. 14x. The key question, however, is what would projected future earnings be, if Brent stays put at $70 per barrel for an extended period. At a lower oil price, the future earnings of some stocks like oil services companies and chemicals producers will be directly impacted, whereas others may suffer a knock-on effect. A significant portion of the GDP growth in Qatar and other GCC countries is driven by government spending, he said. On the impact of sagging oil prices on stocks, he said, most GCC markets dropped by around 4-6 percent on Sunday after the Opec announced its decision not to cut oil production. Qatari market dropped 4.3 percent, with some “overvalued” stocks dropping as much as 7 percent. Over valuation is a problem. Many investors are now probably contemplating their next moves, buy or sell, or even exit the market. “In times like these we recommend those investors who have a long term horizon to take advantage of it. We are currently experiencing a window of finding good “cheap” stocks….. At lower oil prices, certain stocks will see lower profits ahead, but others will not be much affected and hence the recent fall in stock prices just makes them more attractive for the long run,” he said.

The Peninsula