Al-Beit Al Mali Fund

Objective

The fund's objective is to achieve capital appreciation by investing in Sharia-compliant companies listed on the Qatar Exchange as per the predefined Sharia criteria set forth in Qatar.

Fund Overview

| Asset Type | Equity |

| Geographic Focus | Qatar |

| Fund Manager | Amwal LLC |

| Founder | Investment House Co. |

| Regulator | Qatar Central Bank S&P Qatar Domestic Capped |

| Benchmark | Index |

| Fund Listing | None |

| Launch Date | September 2006 |

| Structure | Open-Ended |

| Base Currency | Qatari Riyal |

| Initial Investment | QR 250,000 |

| Subsequent Investment | QR 25,000 |

| Subscription & Redemption | Monthly |

| Initial Charge | 2% |

| Management Fee | 1.00% per annum |

| Custodian Fee | 0.50% 15% over any annual return |

| Performance Fee | exceeding 10%. |

| Redemption Fee | None |

| Custodian | Qatar National Bank |

| Auditors | Ernst & Young |

| License No. of Fund | I.F/5/2006 |

| Fund registration No. at Ministry of Economy & Commerce | 33162 |

| Fund Website | www.abamfund.com |

Performance

Equities saw a moderate sell off in April following a strong March. The S&P Qatar Domestic Capped Index was down -2.5%, while the fund was down -2.3% in April. Uncertainty over future price of oil has the biggest impact on stock market volatility in our view. Based on current earnings, fundamental valuations are attractive but future earnings depend significantly on oil price, and as a result government spending. Our view remains positive on oil but it is difficult to be certain, particularly with the drop last year to fundamentally unjustified low levels. Our strategy is to be neutral on stocks highly correlated to oil unless they trade at very attractive valuations. Our portfolio is tilted more towards value and defensive stocks which have a more certain earnings outlook and good dividend pay-out.

Notable stock moves in April included Medicare (1.5% weight in portfolio) which was down 15% after weak Q1 results. Real estate stocks were down 6-10% and Islamic banks were down around 5-6%. Among the few positive performers were Gulf Warehousing up +10% after good Q1 results and QIMD/Qatar Fuel up around 1-2%.

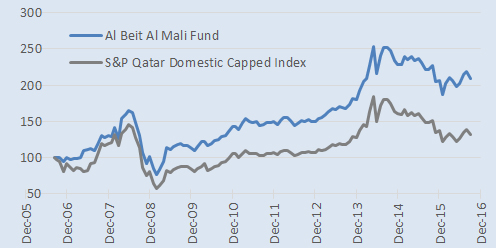

Al-Beit Al Mali Fund Performance

Manager’s Commentary

The Qatari market slipped into negative territory (approx. 5 %) in September 2016 which made QE the second worst performing index in the region. Analysts had anticipated $300-500 million of new funds coming into the market on QE inclusion in FTSE Emerging Market Indices, but new money apparently dripped slowly into the market in the following few weeks. This was against the investor’s (mainly retail) sentiment. They panicked on anemic demand and started liquidating their positions before the long Eid holiday and climaxed right after it.

The fund, after building a cash cushion during August 2016, had started buying beaten down stocks but investors soon realized their negative sentiments were far-stretched and started indiscriminately bidding up prices. This increased prices from September lows to August highs for some major stocks. The fund took advantage and started reducing again some volatile positions and reallocating to more defensive stocks, on expectation of a dismal earnings season.

During the month, the fund lost 4.3% (net after fees and expenses) which is similar to the return of the benchmark Index. The reason for this being the fund having positions equal to the heavy weights in the benchmark. YTD the fund is up 1.4% while the benchmark is down by -3.6%, which shows the fund has outperformed the Index by 5%.

Al-Beit Al Mali Fund Documents

Factsheet 2018

2018-11 ABAM Fact Sheet - Investors- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

Factsheet 2017

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

Factsheet 2016

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016