June 2016

GCC Equity Markets Update

Oil and equity markets have both recovered from their lows at the beginning of the year and holding on despite “Brexit”. In this investment outlook piece, we share our updated thinking particularly on whether to increase or decrease regional equity weights in your portfolios.

Has our thinking on oil changed since?

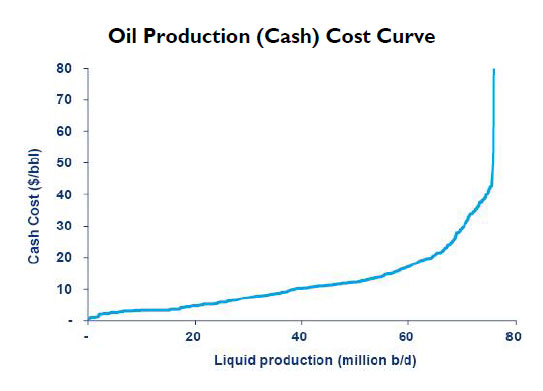

As readers recall, when oil was around US$ 30 per barrel of Brent, we considered it too low, primarily based on a production cost curve analysis. We believed oil would recover initially to around US$ 45 and eventually to around US$ 60-70. Brent is now around US$ 50 per barrel.

Our view on oil has evolved a little, particularly about its long term prospects, in light of what we have been reading about electric vehicles. Before we examine this impact further, we would particularly highlight oil’s steep cost curve as the main reason for oil price sensitivity. While at current annual demand levels of around 95 mbpd, marginal cash cost is above US$ 70 per barrel. This drops to around US$ 45 at an annual production level of below 80 mbpd. So any material long term shift in oil substitution impacts long term views on oil price.

Impact of Electric Vehicles

Recent detailed articles on Bloomberg and The Economist, which drew from several experts and sources of research, concluded that the pace of adoption of electric vehicles is difficult to predict. However, if it is anything like the adoption of computers or smart phones (or even the move from horse-driven carriages to cars in the early 20th century), it could cause a major impact on global oil demand.

Transportation demand makes up more than 70% of global oil demand. That said we do not see this as an imminent threat, but we do feel developments need very close monitoring. Tesla’s market cap of US$ 32bn, is proof that the financial markets are assigning a sufficiently large probability to the success of electric vehicles. This is about the market cap of Renault and Fiat/Chrysler combined, two firms that account for around 14% of the global automotive market.

The reason we do not see electric vehicles as an imminent threat is two-fold. First, the issue of an efficient battery that can charge reasonably quickly and last a good range is still work-in-progress (though it is worth pointing out that the mass market Tesla Model 3 is expected to have a range of 350 kms).

Second, demographic trends are still looking very favorable for demand growth. While car ownership may have saturated in the developed world at between 500-700 cars per 1000, it is still growing rapidly in developing countries. Today China is estimated to have less than 50 cars per 1000, and India and Africa less than 20. As income distribution improves, addressable market will rapidly increase. In terms of population, these countries account for close to 2/3rd of world population and have car ownership of below 100 per 1000. So while product substitution may take place in the future, growth in demand is continuing rapidly. Hence unless there is a major breakthrough in technology, we think oil demand is not likely to be materially lower in the foreseeable future. Although global growth particularly in light of recent events (i.e. Brexit and potential future exit of other countries from EU) needs to be closely monitored.

If oil stayed at current levels, is fiscal sustainability a worry in the GCC?

Fiscal sustainability is not a major worry for GCC countries, except perhaps for Oman and Bahrain. Most countries, even at current oil prices, can meet non-capex spending with revenues at current oil price. Also, capex spending (ex-Saudi) is likely to be materially lower once current mega projects are completed.

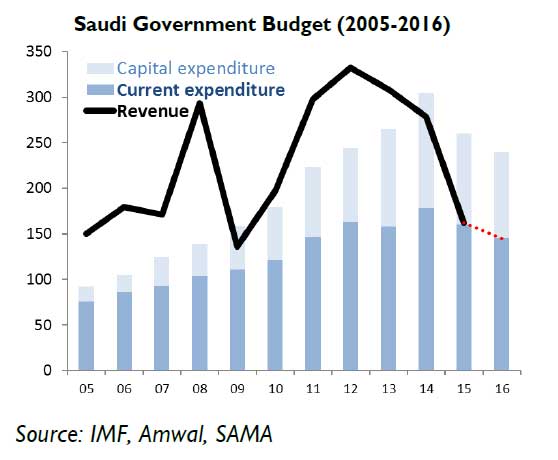

For example, the chart below shows the estimated government revenues vs spending for Saudi. Even at lower revenues (assuming average oil price of US$ 45 per barrel), Saudi can be expected to have sufficient revenues to meet its current spending.

Most other GCC countries appear to be in an even more comfortable position. Let us take Qatar for example. We estimate its revenues will be around US$ 45bn in 2016. While its total spending is around US$ 60bn, around 1/3rd of this is capex spending which will be mostly completed in the next 3-5 years. Further, the government is already taking actions to reduce both current and capex spending and introduce some taxes. Also to note, Qatar does not have property or municipality taxes the same way Dubai does. The UAE generates close to half of its public revenues from non-hydrocarbon sources.

Also importantly, GCC countries do not have any net debt when considering their substantial sovereign wealth, and net government assets at the central bank and foreign banks. Additionally, gross debt is also generally low by any international comparison. Sovereigns have also been highly successful recently in raising debt from international markets (e.g. Saudi US$ 10 bn, Qatar US$ 9 bn, Abu Dhabi US$ 5 bn bond issuance).

How much can spending be reduced?

While government finances are not a worry, having an accurate view on public spending is very important for the equity markets, as it is a key driver of the domestic economies in the GCC. Oil price outlook changed about two years ago materially, which affected government attitude towards future spending. We worry it could change further if governments start to provision for potential impact of electric vehicles (and alternative energy, such as solar) on oil.

Also noteworthy, in comparison to other emerging and even some developed countries, government spending per capita is quite high in GCC (particularly outside Saudi) indicating room for reduction if needed. We estimate total 2016 spending in GCC to be around US$ 500bn. Even excluding investment spending, this figure is still close to US$ 400 bn, having doubled in the last 6-7 years ago.

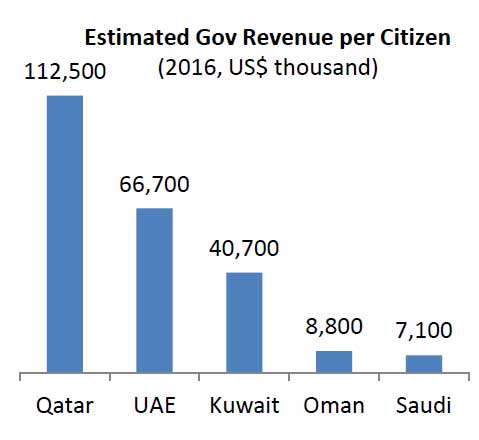

We particularly noticed non-investment spending to be quite high on a per capita (citizen) level in UAE (US$ 65,000), Kuwait (around US$ 40,000) and highest in Qatar (around US$ 125,000). In comparison, OECD countries spend around US$ 18,000 per capita, Norway one of the highest around US$ 28,000, Russia US$ 10,000, Turkey US$ 3,500 and Poland US$ 4,500. The chart below shows estimated public revenues for 2016 per citizen.

How much of likely future spending cuts are already priced in?

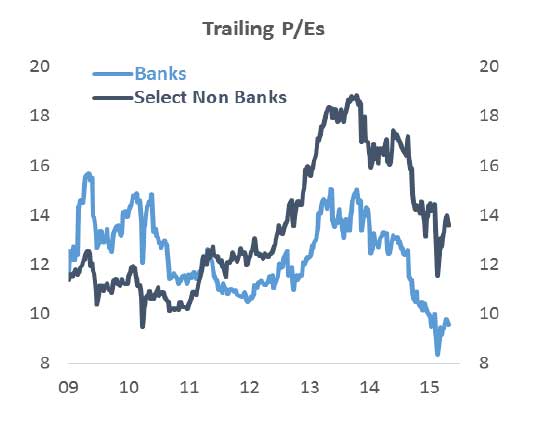

This is the key question for equity investors, as current valuations based on past earnings are quite cheap. Currently banks are valued at around 9x trailing earnings and non-bank stocks (excluding petrochemicals and real-estate) are valued at around 13.5x. Dividend yield based on 2015 dividends is 4.4%, although recent profit trend is around -11% and -5% for non-banks and banks respectively.

Banks are naturally among the most affected stocks. This is both because of the strong correlation between government spending and loan growth, as well as liquidity pressure on margins and rise in NPLs during contractionary periods. That said we feel current valuations are overall quite attractive for picking well-managed and less exposed stocks.

Currently there are very few industries whose valuations we dislike. We do not prefer petrochemicals largely because of their high valuations which appear to be already pricing in the oil price recovery. We are also cautious on some real estate stocks, due to a heavy pipeline of new supply coming to the market.

What should investors do?

We feel this is a very good time to reassess portfolios, and also particularly to address home bias and concentrated positions, which we notice with many investors. While home bias is natural and exists in any market, it is worth remembering the strong correlation of stocks in the GCC to specific factors in particular oil and geopolitics. Also while concentrated positions may have done very well in the last 10 years particularly if bought at discounted IPO valuations, we feel now is a good time to re-assess and diversify.

We still see GCC stocks attractive although risks remain, as with any region. China has its own risks; so does the EU or US, as well as emerging markets, particularly those with current account deficits. Hence diversification can be very beneficial to reduce overexposure to a single market or factor.

Lastly, this report is not meant to recommend a particular investment but rather to share our high-level thoughts on the region. It is intended to give a feel for the level of analysis we do at Amwal, and to assist investors with their overall portfolio allocations.

For detailed analysis and review of your portfolio in the context of your own risk profile and issues discussed in this report, please feel free to contact your sales representative for a more specific review.

- GCC Equity Markets UpdateJune 2016

- Is this the "New Normal" for the GCC?January 2016

- Volatility and Market Efficiency in QatarAugust 2015

- Is it time to buy Qatari equities?December 2014

- Time to diversify into GCC equitiesSeptember 2014

- Are Stocks Expensive Now?June 2014

- Differing prospects for Qatari companies beyond 2022May 2014

- How important are dividends?April 2014

- Outlook for OilFebruary 2014

- Time to Embrace Qatari EquitiesSeptember 2013

- Amwal Investment OutlookDecember 2012

- Amwal Report SpringJune 2011

- Amwal Report SummerDecember 2010